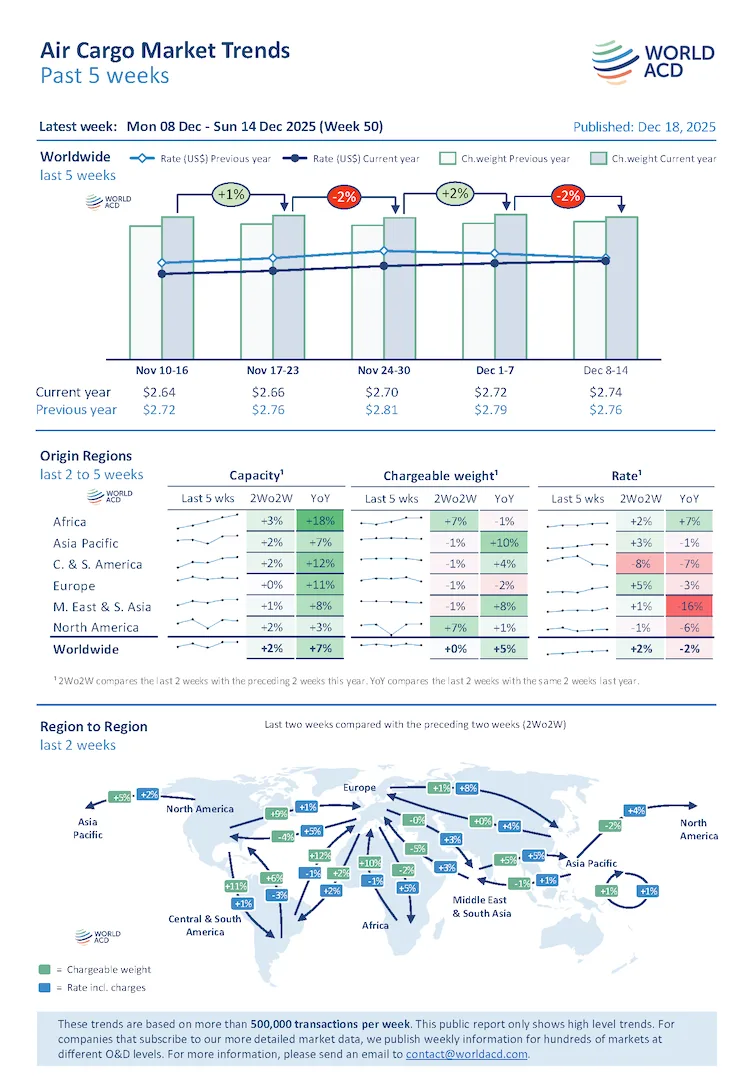

Global air cargo markets reached their seasonal high in early December 2025, with tonnages peaking 5% above last year before moderating in mid-month. Average worldwide rates climbed to $2.74 per kilo, tracking just 1% below 2024’s elevated peak-season levels, a dramatic recovery from September’s 5% year-over-year deficit.

The data, drawn from WorldACD’s analysis of more than 500,000 weekly transactions, shows the market is now past its peak as end-of-year restocking eases ahead of the holiday period. Full-year 2025 tonnages are projected to close approximately 4% higher than 2024, with December alone tracking a 5% year-over-year increase.

For freight forwarders, the peak and subsequent moderation underline a familiar seasonal pattern, strong fourth-quarter demand followed by rapid normalisation. The data highlights how quickly market conditions can shift, reinforcing the need for flexible routing, fast pricing decisions, and access to multiple carriers during peak periods.

Week 50 Signals Market Correction

During the week of December 8–14 (week 50), global air cargo tonnages declined 2% week-over-week while average rates edged up 1% to $2.74 per kilo. The data indicates the start of post-peak normalisation, as seasonal demand eased following several weeks of sustained growth.

Spot rates fell 1% over the same period, suggesting early pricing softening as year-end shipping activity tapered. While rates remain elevated compared to longer-term averages, the gap to last year’s peak-season levels narrowed further toward the end of the quarter.

$2.47 average rate per kilo projected for full-year 2025

What This Means for Freight Forwarders

For SME freight forwarders, the post-peak market environment reinforces the importance of speed, flexibility, and access to diversified capacity. Global average rates reaching $2.74 per kilo during peak season, alongside elevated pricing on key long-haul routes, underline how quickly market conditions can shift.

As volumes ease but capacity remains disciplined, forwarders must adapt routing and pricing strategies in near real time. Multi-leg and alternative gateway routing becomes particularly valuable when direct capacity is constrained or premium pricing persists.

Strong year-over-year growth on Asia Pacific to Europe routes continues to present opportunity. Forwarders with access to wholesale capacity and the ability to quote complex routings quickly are better positioned to capture market share as demand patterns evolve.

To maximise competitiveness, forwarders must focus on rapid quoting, accurate rate visibility, and operational flexibility across multiple carriers and gateways.

Asia Pacific Export Lanes Show Diverging Patterns

Asia Pacific export lanes showed diverging dynamics during week 50 as peak-season demand eased unevenly across major markets. On transpacific routes to the US, tonnages declined 4% week over week, with China to US volumes down 8%. This indicates that pre-holiday shipping activity and earlier pre-positioning have largely concluded.

Despite softer volumes, pricing on Asia Pacific to US routes remained firm. Spot rates increased 3% week over week to $6.57 per kilo, supported by continued capacity tightness. Several origin markets recorded notable rate strength, with Hong Kong to US spot rates rising 12% to $6.92 per kilo, South Korea to US up 15% to $5.79 per kilo, and Singapore to US also up 15% to $6.43 per kilo. China to US rates held steady at $6.96 per kilo. This divergence between falling tonnages and rising rates suggests that available space on transpacific routes continues to command premium pricing even as seasonal demand eases.

By contrast, Asia Pacific to Europe continued to outperform other major export corridors on a year-over-year basis. Tonnages on this lane tracked 11% higher than last year, making it the strongest-performing major trade lane in 2025. While volumes declined modestly by 2% week over week in week 50, the underlying growth trend remains intact.

Several Asian origins posted double-digit year-over-year growth into Europe, including Taiwan at 27%, Vietnam at 16%, Hong Kong at 15%, Indonesia at 12%, and China at 11%. Spot rates on the Asia Pacific to Europe lane increased 1% week over week to $4.70 per kilo, while China to Europe rates climbed 4% to $5.21 per kilo and now sit 8% higher year over year. This pricing behaviour contrasts with transpacific dynamics and reflects differing supply-demand balances across the two corridors.

Across both export lanes, the data points to a market transitioning out of peak season, with volumes beginning to normalise while pricing remains supported by disciplined capacity deployment.

Rate Divergence Across Asian Origins

Not all Asian origin markets to Europe experienced rate growth. Hong Kong to Europe rates stood at $5.53 per kilo, down 13% year-over-year. South Korea to Europe rates tracked at $4.76 per kilo, down 10% year-over-year. This divergence reflects the varying supply-demand dynamics and capacity deployment across different origin points.

Capacity Expansion Accelerates Across Regions

Total worldwide capacity is projected to end 2025 approximately 7% higher year-over-year, a significant expansion that has helped accommodate the 4% tonnage growth while keeping rates relatively stable compared to 2024’s elevated levels.

Capacity growth varied substantially by region, with some areas experiencing double-digit increases:

- Africa origins: Capacity up 18% year-over-year

- Central & South America origins: Capacity up 12% year-over-year

- Europe origins: Capacity up 11% year-over-year

- Middle East & South Asia origins: Capacity up 8% year-over-year

- Asia Pacific origins: Capacity up 7% year-over-year

- North America origins: Capacity up 3% year-over-year

This capacity expansion reflects continued confidence from carriers in air cargo demand, with belly capacity returning as passenger networks rebuild and dedicated freighter operations expanding on key lanes.

Rate Environment Shows Resilience

The global rate environment demonstrated remarkable resilience throughout 2025. After starting the year with rates tracking 5% below 2024 levels in September, the gap narrowed progressively through the fourth quarter to just 2% below last year in December.

Average worldwide rates climbed from a September low to reach $2.74 per kilo in week 50, just 1% below the equivalent rate last year. For the full year, rates are projected to average around $2.47 per kilo, broadly similar to 2024 levels despite the significant capacity expansion.

This rate stability occurred against a backdrop of 7% capacity growth, suggesting that demand fundamentals remained robust enough to absorb the additional space without triggering significant price erosion.

Structural Demand Reset Supports Elevated Volumes

While growth moderated from the exceptionally strong conditions seen in 2024, air cargo demand over the past two years indicates a structural reset at higher volume levels compared to pre-2023 norms. The projected 4% growth in global tonnages for 2025 follows an 11% expansion in 2024, reflecting a market that has stabilised rather than reversed.

For freight forwarders, this pattern highlights a shift in shipper behaviour. Greater emphasis on speed, reliability, and inventory resilience continues to support air cargo volumes, even as supply chains normalise and capacity expands.

This environment favours forwarders with diversified carrier relationships and flexible routing options. Rather than relying solely on short-term spot opportunities, consistent access to capacity and the ability to balance contract and spot strategies have become increasingly important in maintaining service levels and protecting margins.

Market Outlook: Post-Peak Normalisation

With the market now clearly past its peak, the coming weeks will likely see continued normalisation in both rates and tonnages. The traditional post-holiday slowdown typically extends through January and early February before spring demand begins to build.

Several factors will shape market dynamics in early 2026:

- Lunar New Year timing: Factory closures in Asia will temporarily reduce origin volumes

- Capacity discipline: Whether carriers adjust capacity deployment to match lower demand

- Economic indicators: Global growth signals and consumer spending patterns

- Trade policy: Any tariff or trade agreement changes affecting major lanes

- E-commerce trends: Sustained growth in cross-border online retail driving air cargo demand

The rate environment is expected to soften from peak-season levels but may remain above historical averages if capacity discipline holds and underlying demand proves resilient.

Speed to Quote Drives Competitive Advantage

With spot rates fluctuating week-over-week—sometimes by double-digit percentages on specific lanes—the ability to quote accurately and quickly separates winning forwarders from those left behind. Access to live rates across verified partners eliminates the time-consuming email chains and spreadsheet comparisons that slow response times.

As capacity deployment shifts by region, with Africa up 18% and North America up just 3%, forwarders need visibility across global networks to identify available space and competitive pricing regardless of origin or destination.

Looking Ahead

The air cargo market exits 2025 in a position of relative strength. Tonnages grew 4% despite significant capacity expansion, rates remained near 2024’s elevated levels, and multiple trade lanes demonstrated robust growth.

The key question for 2026 is whether demand fundamentals can sustain current rate levels as capacity continues to expand. Early indicators suggest a normalisation period through the first quarter, followed by renewed growth as spring demand builds and any pent-up inventory needs emerge.

For forwarders, the priority remains clear: maintain speed to quote, access to diverse capacity, and the flexibility to route cargo via the most efficient and cost-effective paths. Those capabilities determine who wins cargo and who protects margin in a dynamic rate environment.

Market statistics referenced in this article are based on publicly published WORLD ACD weekly trend reporting and industry commentary.